This article will give you a list of the best 10 loan apps you can get fast and easy loans from in Nigeria, plus it wouldn’t require you to go to the bank and face queues or cashiers. This list curates the most trusted services, quality customer representatives, and trustworthy platforms.

Most of us don’t desire it, no one wants to be in the state where you need money urgently and you check your account and other places you keep funds and there’s nothing, at least not enough to meet up that urgent need, the lack can be a nightmare, especially for those of us with incredible responsibility, but sadly this reality comes not often, but at some point, in life and you will need urgent funds to pull through.

Starting a business, funding the idea, and getting funds enough for running costs can be very exhausting financially, and sometimes we do want this easy way out. Well, if you are in this phase a loan might just be right to get things back on track.

BUY AND SELL PHONES NOW FOR FREE – visit

Table of Contents

List of Best 10 Loan Apps in Nigeria

| Loan Apps in Nigeria | Interest Rate |

| Carbon | 2% to 30% |

| Fairmoney | 2.5% to 30% |

| Palm Credit | 4% to 24% |

| Branch | 3% – 21% |

| Aella Credit | 2% – 20% |

| Quick Check | 2% – 30% |

| Kwikmoney (Migo) | 4% to 25% |

| Sokoloan | 4.5% to 35% |

| Kiakia Loan | 5.6% to 24% |

| Creditville | 5% to 25% |

Best Loan Apps in Nigeria

1. Carbon (Paylater)

You can’t talk about loan apps in Nigeria and ignore Pay later now known as carbon. If you want to loan quick money either for business or personal needs, then Carbon is just right because they answer and grant loans almost instantly.

Follow us on Instagram for latest gadgets updates and giveaways @naijagadgetsdotcom

They give loans to all students, entrepreneurs, monthly salary earners, etc. No need for guarantors, no need for collateral, and you can apply 24/7 and receive funds within a few minutes.

Visit Google Play Store or their site to get the app, register, and then follow the instructions to apply.

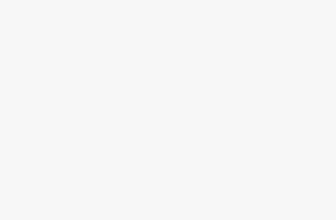

2. Fairmoney

There is no way you are YouTuber and you have never come across Fairmoney ads, there are captions are “no collateral, no paperwork”, and yes, it is true no collateral required and no paperwork either, from this app you can get as much as 150,000 naira and it is 100% stress-free.

This app allows you to spread your repayments into multiple installments for more ease for you. The user interface of this app is quite friendly and the icing on the cake is you can get your bill payment done and a 5% discount on airtime recharge using the app. Google Play Store, has this app ready for download.

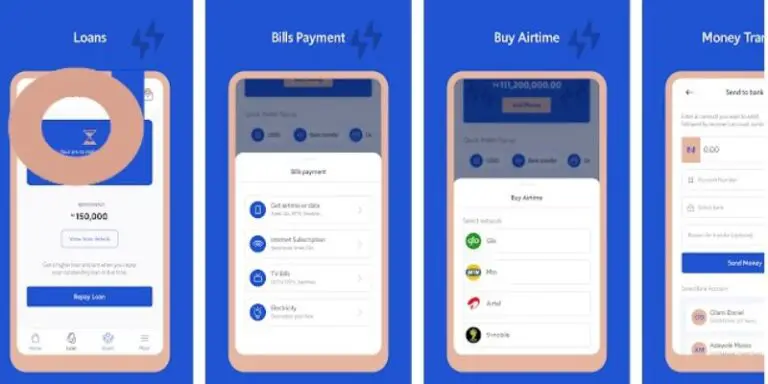

3. Palm Credit

Next on the list is Palm Credit, this takes third place because of its range of loans, you can get as slow as an “Urgent 2k” loan to as high as 100,000 naira directly from the app.

You can get loans from this app is quick and easy steps and Palm credit gives referral rewards. Download the Palm credit app from Google Play Store, follow the instructions, and get that loan you need.

4. Branch

You can borrow as slow as 1,000 naira and as high as 200,000 naira from the branch app, and with little interest rates. Your interest rate varies from country to country, depending on where you are paying from. They are also fast and reliable.

5. Aella Credit

Aella Credit is known for its quick response from its customer care desk, ready to give answers to any inquiry. They give instant loans online in Nigeria, without hassle or stress.

Simply download the application from Google Play Store, and in registering, ensure to fill in the correct details, if not getting a loan will be impossible.

6. Quick Check

This loan app is unique because you can choose when to pay back what was borrowed. Download the app from Google Play Store and get an instant loan to your bank account with single-digit interest rates.

7. Kwikmoney (Migo)

Here you don’t need an app to get a loan, all you need is your smartphone and a sim register to your bank account, this makes this platform unique.

No paperwork is required, the earlier you repay, the higher they are willing to offer next time.

With your smartphone and sim, you can initiate a loan request, and you will be given 14 to 30 days to repay, if you repay before the 14th day, there will be no interest, but if you repay after the 14th day there will be a 5% interest increment on the money borrowed.

8. Sokoloan

This is a microfinance institution intending to increase opportunities for the poor to access financial aid by providing financial loans to low-income entrepreneurs.

The app is easy to use, at any time to get short-term loans. Just like Kwikmoney, the earlier you pay, the more you increase your loan limit. Go to Google Play Store to get the app.

9. Kiakia Loan

In Yoruba, “Kiakia” means fast fast, they measure up with the title of the brand with their swift loan approval system. If you have a business and you need funds, just dial *822# on your mobile phone, you can get access to a loan from Sterling bank, the official owner of Kiakia loan. Visit their official website (Kiakia.co/) and start your loan process.

10. Creditville

Last but it’s not least is Creditville which offers from 100,000 naira to 4,000,000 (four million naira) for up to 18 months without collateral, However, this app is strictly for salary earners and business owners.

It is fast and stress-free, just visit their official website, fill out the application form, and you will get your loan in quick time.

Lending money from a friend may be great but as you know, we are all going through one challenge or another and that includes our friends. In any case, using loan apps is totally up to you.

You have seen my 10 best loan app list, I’m certain there is something there for everyone’s level. You can make your choice and get on with the application for your loan or not.